Corentin Derbré

Books:

Quantitative Trading – Ernest P. Chan

ISBN: 0470284889

Date read: 2016-06-06

How strongly I recommend it: 7/10

(See my list of books, for more.)

Go to the Amazon page for details and reviews.

Good introduction to quantitative trading. Some parts are complicated and require a decent finance, programming, math and portfolio optimization knowledge. Also talks about setting a business up and developing algorithm ideas.

my notes

Quantitative Trading – Ernest P. Chan

ISBN: 0470284889

Date read: 2016-06-06

How strongly I recommend it: 7/10

(See my list of books, for more.)

Go to the Amazon page for details and reviews.

Good introduction to quantitative trading. Some parts are complicated and require a decent finance, programming, math and portfolio optimization knowledge. Also talks about setting a business up and developing algorithm ideas.

my notes

Quantitative Trading – How to Build Your Own Algorithmic Trading Business

You do need to possess some basic knowledge of statistics, such as how to calculate averages, standard deviations, or how to fit a straight line through a set of data points.

This is a book that teaches you how to find a profitable strategy yourself.

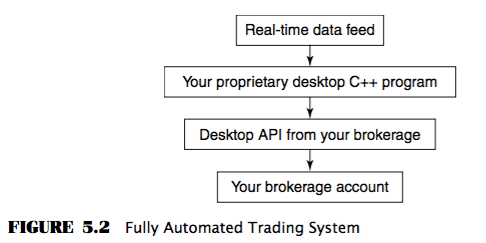

Implementing an automated execution system in your own home.

The Whats, Whos and Whys of Quantitative Trading

A lot of us are in the business of quantitative trading because it is exciting, intellectually stimulating, financially rewarding.

Quantitative trading takes relatively little of your time. For example, at a hedge fund I used to work for, some colleagues come into the office only once a month.

Alas, the spirit is willing but the flesh is weak: I often cannot resist the urge to take a look (sometimes many looks) at the intraday P&L of the various strategies on my trading screens.

Alert my mobile phone or a technical support service when something goes wrong.

If you need time and financial resources to explore other businesses, quantitative trading is the business for you.

Fishing for ideas

In general, I would not recommend quantitative trading for an account with less than $50,000 capital.

There is a misconception aired by some investment advisers, though, that if your goal is to achieve maximum long-term capital growth, then the best strategy is a buy-and-hold one. This notion has been shown to be mathematically false. In reality, maximum long-term growth is achieved by finding a strategy with the maximum Sharpe ratio (defined in the next section), provided that you have access to sufficiently high leverage.

For a strategy that achieves profitability almost every month, its (annualized) Sharpe ratio is typically greater than 2. For a strategy that is profitable almost every day, its Sharpe ratio is usually greater than 3.

You have to ask yourself, realistically, how deep and how long a drawdown will you be able to tolerate and not liquidate your portfolio and shut down your strategy? Would it be 20 percent and three months, or 10 percent and one month?

The more frequent it trades, the larger the impact of transaction costs will be on the profitability of the strategy.

(If you find that it is a gain on average, you should change your program to deliberately delay the transmission of the order by a few seconds!)

But, in general, the more rules the strategy has, and the more parameters the model has, the more likely it is going to suffer data-snooping bias. Simple models are often the ones that will stand the test of time.

How much time do you have for baby-sitting your trading programs?

How good a programmer are you?

How much capital do you have?

Is your goal to earn steady monthly income or to strive for a large, long-term capital gain?

Backtesting

Quantitative traders use a good variety of performance measures. Which set of numbers to use is sometimes a matter of personal preference, but with ease of comparisons across different strategies and traders in mind, I would argue that the Sharpe ratio and drawdowns are the two most important.

Simplify the model. In general, you should eliminate as many conditions, constraints, and parameters as possible as long as there is no significant decrease in performance in the test set.

Consider dividing the trading capital across the different parameter values and sets of conditions.

No backtest performance is realistic without incorporating transaction costs.

Whatever changes you make to the strategy to improve its performance on the training set, it must also improve the performance on the test set.

Execution Systems

A good operating environment (at first, nothing more than a computer, a high-speed Internet connection, and a real-time news-feed).

Knowledge of high-performance programming languages such as Java, C#, or C++ in order to connect to your brokerage’s application programming interface (API).

Your brokerage will usually provide API for some popular programming languages such as Visual Basic, Java, C#, or C++, so your fully automated system must also be written in one of these languages.

In order to minimize market impact cost, you should limit the size (number of shares) of your orders based on the liquidity of the stock.

After you have built your automated trading system, it is a good idea to test it.

So data-snooping bias can usually be discovered only when you have actually started trading the system with a small amount of capital.

But what if after one month, then two months, and then finally a quarter has passed, the strategy still delivers a meager or maybe even negative returns. This disappointing experience is common to freshly minted quantitative traders.

Gain important intuition about P&L volatility, capital usage, portfolio size, and trade frequency.

In despair, one tries to recoup the losses by adding fresh capital; in greed, one adds capital too quickly after initial successes with a strategy. Therefore, the one golden rule in risk management is to keep the size of your portfolio under control at all times. Do not succumb to either despair or greed.

Special Topics in Quantitative Trading

Mean-reverting versus momentum strategies.

What is your exit strategy?

A fixed holding period

A target price or profit cap

The latest entry signals

A stop price

High Frequency: Transaction costs are of paramount importance in testing such strategies. Quite often, the only true test for such strategies is to run it in real-time.

Conclusion

It is far, far easier to generate a high Sharpe ratio trading a $100,000 account than a $100 million account.

Long-only strategies are often easier to find, simpler, more profitable, and if traded in small sizes, no more risky than market-neutral strategies.